Crypto investment inflows surged to $2.17 billion last week, reaching an unprecedented $29.2 billion in year-to-date inflows. This influx elevated the total assets under management (AUM) in digital assets to over $100 billion, a level previously reached only in June 2024.

The rise comes amid renewed interest in Bitcoin, which captured the majority of these investments, with trading volumes up by 67% to $19.2 billion. This activity represented a significant 35% of Bitcoin’s trading volume on trusted exchanges.

Inflows To Digital Asset Investment Products Reach $2.2 Billion

The latest CoinShares report attributes recent crypto inflows to the upcoming US elections on November 5. Anticipation of a potential Republican victory appears to be fueling interest, as the GOP is often viewed as more favorable toward relaxed regulations on digital assets.

“We believe euphoria around the prospect of a Republican victory was the likely reason for these inflows as they were in the first few days of last week, as polls have turned, we saw minor outflows on Friday, highlighting how sensitive Bitcoin is to the US elections at present,” the report read.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Bitcoin dominated last week’s inflows, with $2.15 billion reflecting investor confidence. A minor yet notable $8.9 million also flowed into short-Bitcoin products, hinting at some hedging among investors amidst Bitcoin’s strong price movement.

Meanwhile, Ethereum saw modest inflows totaling $9.5 million, displaying a marked difference in sentiment compared to Bitcoin and Solana, which received $5.7 million. Other altcoins, including Polkadot and Arbitrum, saw smaller investments, with $670,000 and $200,000 respectively.

This development is unsurprising given how the run-up to the US elections has catalyzed substantial interest in digital assets over the past few weeks. As BeInCrypto reported, October already saw inflows reaching $901 million in the last week after recording up to $2.2 billion in positive flows the week prior and $407 million in the first week of October.

During these weeks, CoinShares’ James Butterfill credited the positive flows to a Republican victory potentially favoring regulatory policies for digital assets.

Fate of Crypto Investment Inflows After US Elections

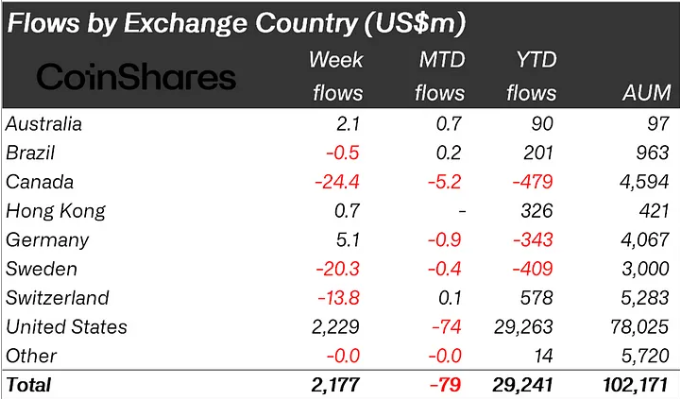

The record-breaking inflows coincide with a broader surge in US-based investments in crypto, as American investors account for the bulk of this year’s $29.2 billion inflow. Meanwhile, Germany saw a modest $5.1 million in new investments. This reflects Europe’s more conservative engagement with crypto amid regulatory uncertainties.

While Bitcoin remains the primary beneficiary of these investments, US elections could further intensify volatility in the crypto market this week. Investors are monitoring key battleground states, where recent polls indicate a favorable swing for Republicans. This has raised speculation of a shift in Congress that could bring a friendlier stance on crypto.

Political analysts note that GOP control of Congress might ease regulatory pressures on digital assets. This could enhance investor confidence and attract further inflows into Bitcoin and other cryptocurrencies in the days following the elections. Nevertheless, others like Coinbase CEO Brian Armstrong say a more “pro-crypto Congress” is likely to emerge regardless of the election’s outcome.

The election results will likely signal the short-term direction for crypto investments. A Republican win could boost inflows, potentially sparking a new Bitcoin rally, while a Democratic victory might dampen expectations if stricter regulations are anticipated.

Read More: What is Polymarket? A Guide to The Popular Prediction Market

With election day approaching, crypto markets are expected to stay volatile, as Bitcoin and other digital assets respond to shifts in polling data and policy outlooks.

“Going to be an exciting week ahead, that’s one thing that’s for certain. Be careful on leverage, recommend not touching it at all this week. You’re likely to just get chopped up,” crypto analyst Daan Crypto warned.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment